PSD2 API

The documentation for the iBanFirst PSD2 API is designed to assist developers, financial institutions, and aggregators in implementing the API specifications mandated by PSD2 (Payment Services Directive 2).

iBanFirst PSD2 API

The iBanFirst’s PSD2 API can be used for both Account Information (AIS) and Payment Initiation Services (PIS).

Our API is certified and iBanFirst is exempted from any fallback mechanism in the context of PSD2.

Since our priority is to secure customer’s data and ensuring a smooth customer experience, our PSD2 API is based on a common “redirect” method (defined in standards such as OAuth2.0).

According to PSD2 regulations, our PSD2 API is totally free for clients.

If you are a registered Third-Party Provider (TPP), with a qualified EIDAS QWAC and wish to use iBanFirst API, please contact us at open-api@ibanfirst.com

Open Banking with PSD2

The revised Payment Services Directive (PSD2) requires banks to allow Third-Party Providers (TPPs) to access account and make payments on their customer’s behalf and with their consent.

This regulation ensures that banks put into place the necessary systems to securely and reliably share their services and data with registered TPP.

APIs are already widely used across the internet to share information and provide secure access to accounts and payment services.

Sandbox Credentials

Our PSD2 API Sandbox is an open environment that allows to experiment, develop and test TPP’s application for the PSD2 services. It covers accounts information, payment initiation and secure customer authentication.

After using the following credentials to register yourself, you can submit API requests and receive simulated responses.

Login: m01148y

Password: AccountPSD2

Authentication: 000000

Test URL: https://open-api-sdbx.ibanfirst.com/Banking/API

EUR IBAN: BE90 9140 0154 4332

USD IBAN: BE68 9140 0154 4534

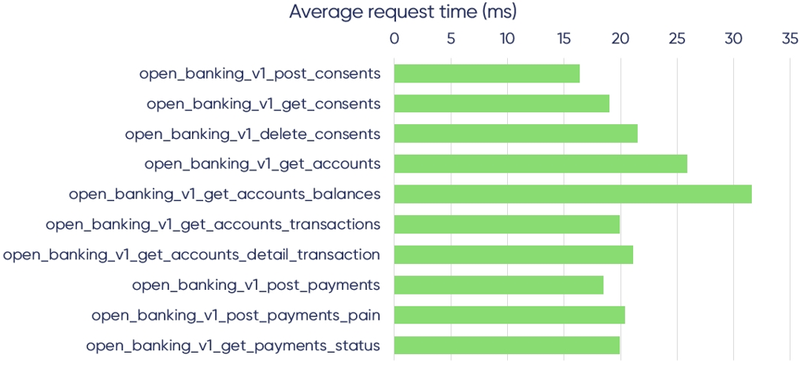

Performance

API Documentation

Begin vandaag nog

iBanFirst S.A. is vergund en gereglementeerd door de Nationale Bank van België als betalingsinstelling (onder ondernemingsnummer 0849.872.824). Onze maatschappelijke zetel is gevestigd te Louizalaan 489, 1050 Brussel, België. De producten en diensten die iBanFirst S.A. aanbiedt, zijn beperkt tot onderliggende niet-gereguleerde contante FX-transacties en leverbare valutatermijn betalingen (valutatermijn betalingen, flexibele valutatermijn betalingen en dynamische valutatermijn betalingen) die zijn uitgesloten van de MiFID- en EMIR-regelgeving, aangezien ze bedoeld zijn om een toekomstige betaling voor identificeerbare goederen en diensten te dekken. iBanFirst S.A. biedt geen opties of andere financiële instrumenten aan voor beleggings- of speculatieve doeleinden.